Overview of statutory tax report

Compared to tax returns, it seems that many people are not sure about statutory tax report. Let us explain it.

-

What is ‘statutory tax report’?

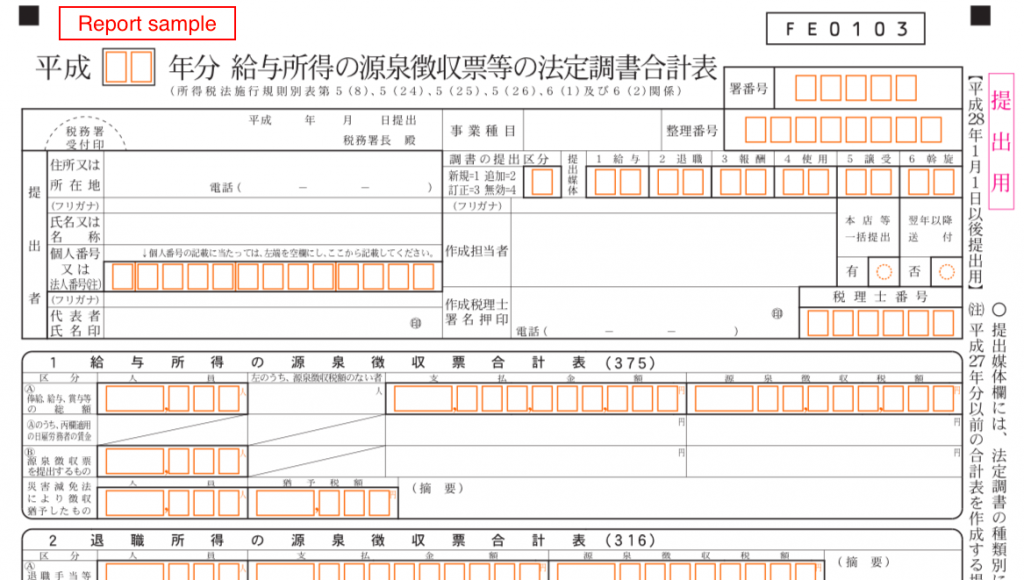

Statutory tax report(In Japanese, Houteichosho Goukeihyo) is a summary regarding certain payments such as salaries, retiring allowances, professional (e.g. lawyer, accountant, etc.) fees, rental fees for offices. This report has to be submitted to the Japan tax office under the tax law.

Actually, there are many types of statutory tax reports covering various kinds of payments. Thus you need to be careful with payments such as fees for individuals or non-residents.

-

What is the purpose?

Realisation of proper and fair collection of Japan taxes. It is difficult for the Japan tax offices to know companies’ transactions only through their tax returns. The statutory tax report can be a supporting document that helps the Japan tax office understand that tax returns are filed and the taxes are paid correctly.

-

Who has to submit this report?

You (corporation or individual) have to submit the report when you pay salary, retirement allowance, professional fees, rental fees for offices, etc. Thus probably you must file it unless you are in the process of closing your business.

-

When should the report be submitted?

Generally, the reports (covering payments during the year) are submitted by 31st January of the following year. But it depends on the type of the reports (e.g. the report for dividend has to be submitted within a month after the date of the payment).

-

What happens if I failed to submit it?

According to the tax law, you may be punished by imprisonment or a fine of not more than JPY 500,000. We don’t think this happens right after you failed to submit it by the due date.But we recommend you submit it as soon as possible after you realised.

If you are interested in our statutory tax report preparation service, see our service.