Possible to get a Japan consumption tax refund?

What is Japan consumption tax? Consumption tax is quite similar to Value-added tax (VAT) and Goods and services tax (GST) in other countries. And we highly recommend you think about getting a Japan consumption tax refund especially when you have just set up a company in Japan. You don’t get it automatically. You do need a good strategy.

Can your company file a consumption tax return?

You set up a company in Japan. Do you know whether the company needs a consumption tax return. If needed, it is filed every year. If the company’s capital (the owners’ investment of assets) is less than JPY 10,000,000, the company is ‘usually’ not required to file a consumption tax return for its first fiscal year (When is the fiscal year-end? You can determine.). More precisely, the company is not able to file a consumption tax return. Therefore, no Japan consumption tax refund is available.

Is ‘no consumption tax return’ good?

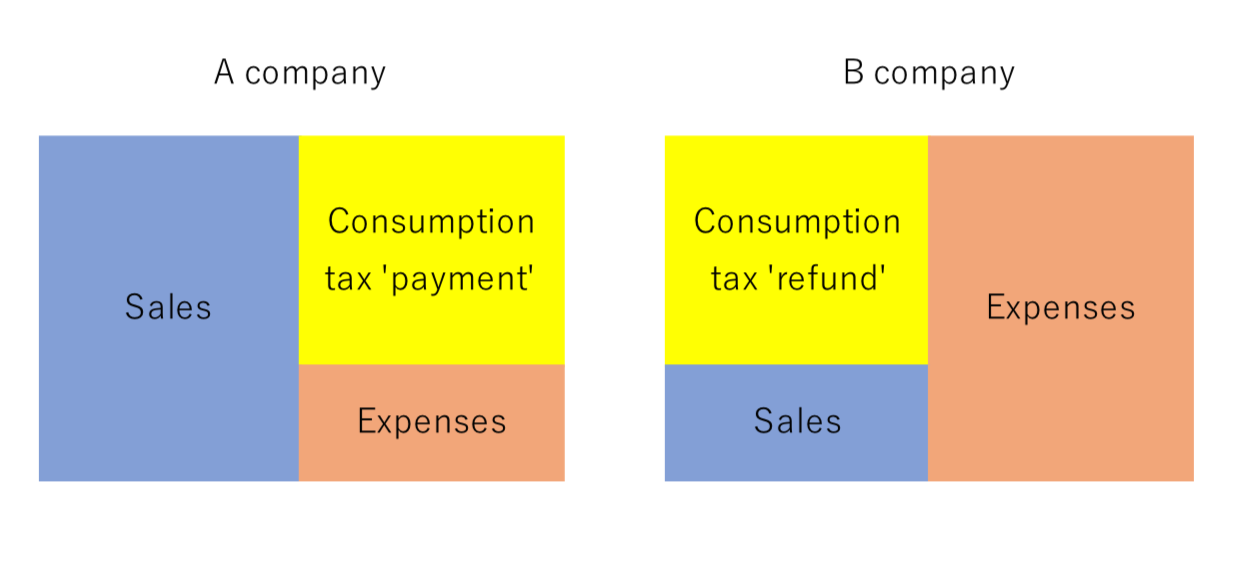

You don’t need a consumption tax return due to its capital? You don’t need a consumption tax payment either. Is this good? See below.

‘A company’ has to pay consumption tax so ‘no consumption tax return’ is good for ‘A company’. However, this does not apply to ‘B company’ because ‘no consumption tax return’ means ‘no refund’. Is your company ‘A company’ or ‘B company’?

‘Tax report’ to get a refund

Are you ‘B company’ but the capital is less than JPY 10,000,000? And you want a consumption tax refund? Then you have to prepare a ‘tax report‘ and submit it to Japan tax office before the first fiscal year-end. Never do this if you are ‘A company’.

Export business is good.

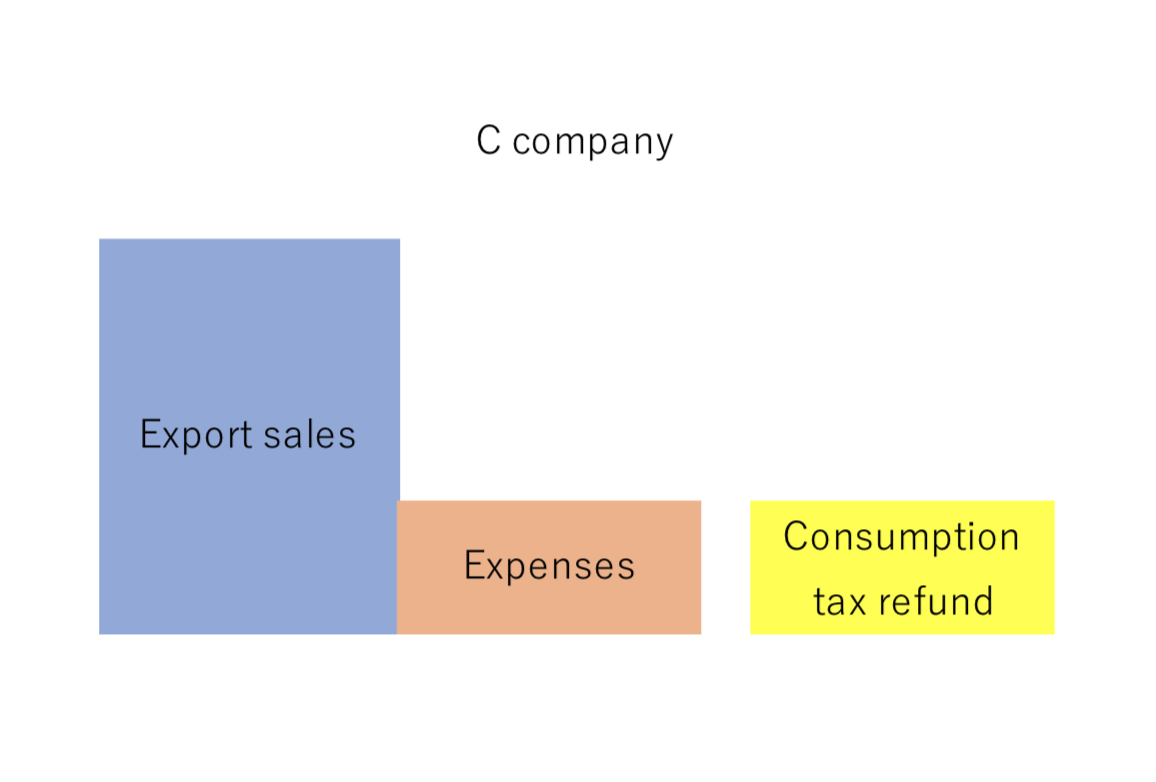

If your business is an export business, you may be able to get a consumption tax refund every year. See below.

‘C company’ exports their products to foreign countries. And the company gets a refund because export sales are different from normal sales in Japan. Consumption tax is a Japan tax and only applies to sales in Japan. For example, companies sell food products in Japan and people consume them in Japan, and the companies receive Japan consumption tax from the consumers and pay it. On the other hand, if foods are exported to foreign countries and consumed there, no Japan consumption tax is paid by the consumers in foreign countries. Thus, the companies do not receive Japan consumption tax from them and no tax payment is needed either.

What is export sales?

Export sales are not just product sales. See below.

- Exporting products to foreign countries

- Leasing of exported products

- Selling and leasing of intellectual property rights to non-residents

- Providing services to non-residents (except services such as transport and foods that are actually provided and consumed in Japan.)

You may be interested in other consumption tax rules.